Holistic performance monitoring

Connect the dots across the life of loans in your portfolio.

SEE HOW

"Compared to other solutions, AINEXT software offers the best combination of performance, transparency, and compliance."

CEO, HawaiiUSA Federal Credit Union

Banks that fail to invest in machine learning will end up fundamentally uncompetitive in a couple of years. We found the best way to drive benefit faster was a partnership with AINEXT.

Rodger Hochschild

Discover CEO and President

Banks that fail to invest in machine learning will end up fundamentally uncompetitive in a couple of years. We found the best way to drive benefit faster was a partnership with AINEXT.

Rodger Hochschild

Discover CEO and President

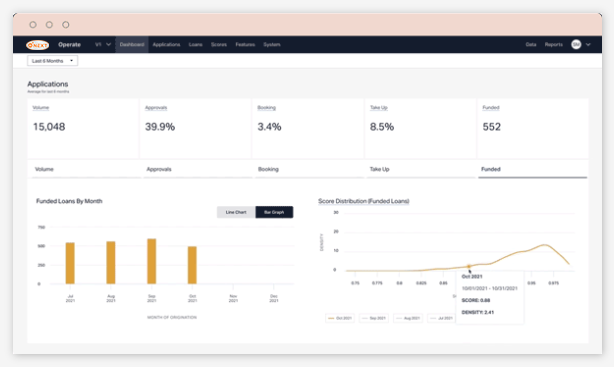

Forget fragmented views of performance

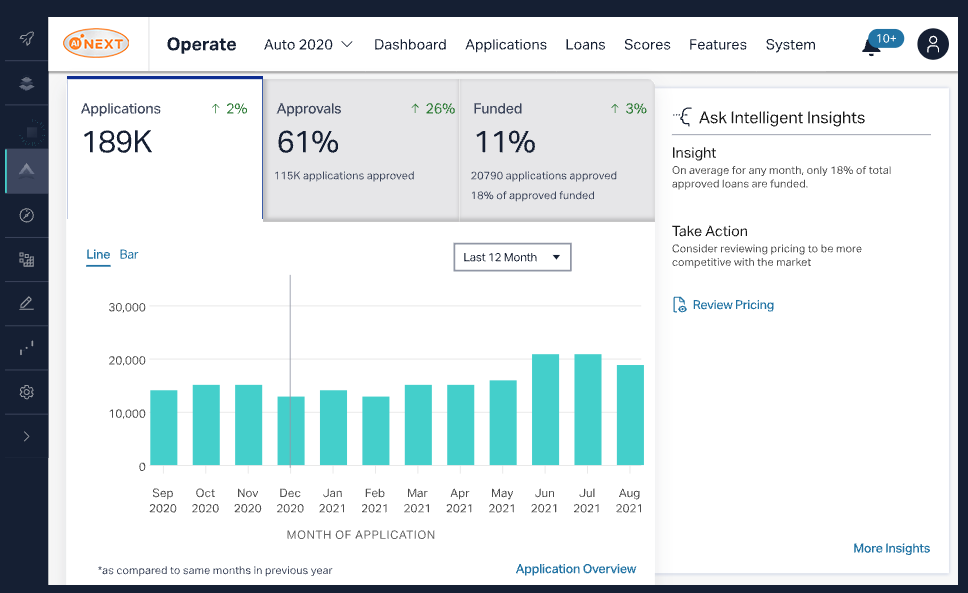

Holistic end-to-end dashboards

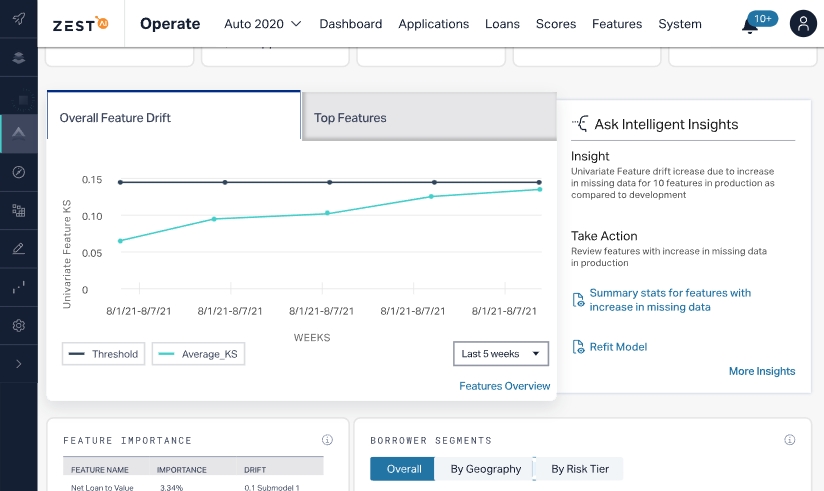

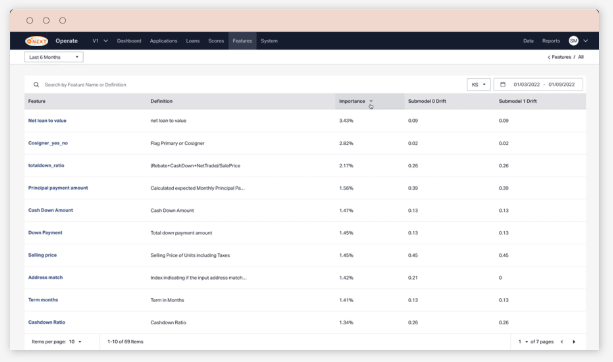

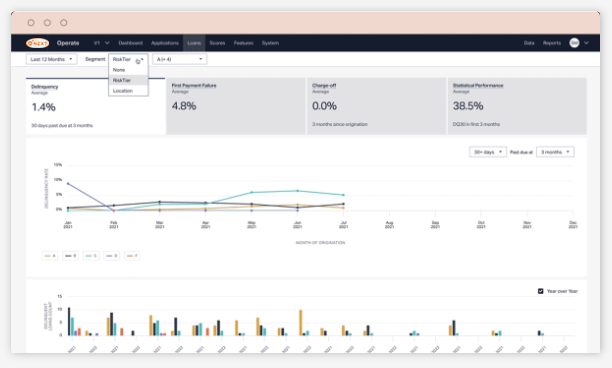

With Operate, analysts can connect the dots—from score distribution, feature importance, and drift to loan volume, booking trends, and borrower changes.

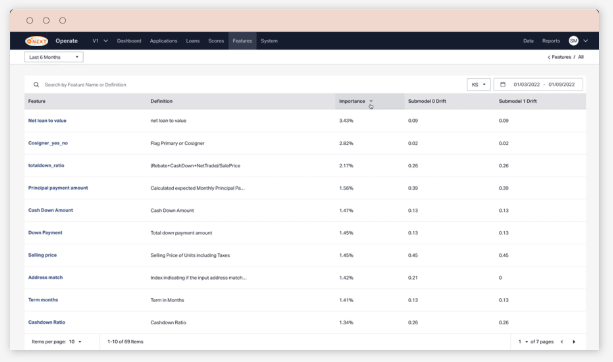

It can be tough to keep pace with a quickly changing market

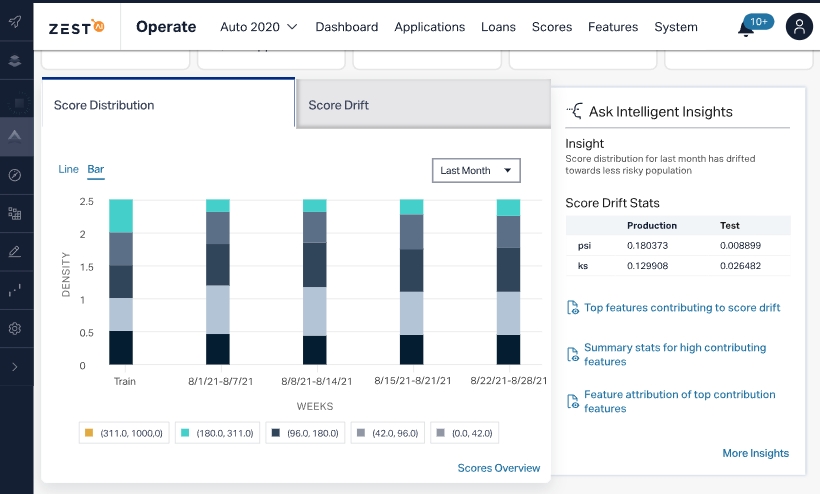

Transparent, reliable credit signals

Machine learning monitors can detect hidden shifts in data that could adversely affect score accuracy and loan performance.

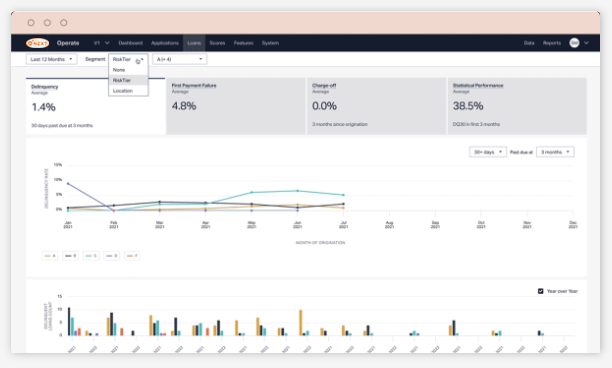

Information overload makes finding insight harder than it should be

Smarter insights for more informed policy

Key insights are easier to identify and share with stakeholders by connecting the dots between credit model performance and loan performance.

Forget fragmented views of performance

Holistic end-to-end dashboards

With Operate, analysts can connect the dots—from score distribution, feature importance, and drift to loan volume, booking trends, and borrower changes.

It can be tough to keep pace with a quickly changing market

Transparent, reliable credit signals

Machine learning monitors can detect hidden shifts in data that could adversely affect score accuracy and loan performance.

Information overload makes finding insight harder than it should be

Smarter insights for more informed policy

Key insights are easier to identify and share with stakeholders by connecting the dots between credit model performance and loan performance.

Worried about responsibly managing a machine learning model? No problem.

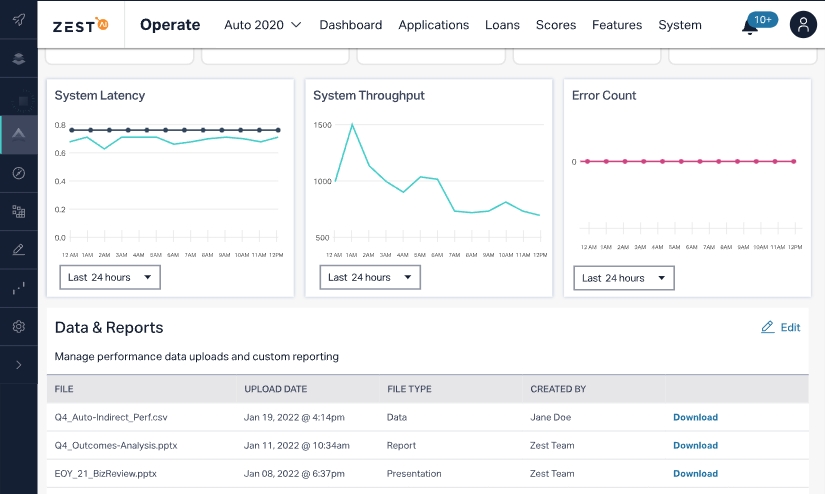

The AINEXT Model Management System comes with sensitive machine learning monitors to ensure your scoring model behaves as expected. Plus, automated model risk management documentation satisfies regulatory requirements for responsible management.

Got Questions?

Many lenders mistakenly believe underwriting algorithms are living, breathing organisms that learn and adapt over time. Far from it! Machine learning lending models are trained and then locked down to pass validation. But they can drift a little if you 're not watching. Monitoring is essential to ensure the model isn 't losing predictive accuracy, especially as products, clients, and market conditions fluctuate.

AINEXT software comes with machine learning monitors that alert you when you cross thresholds for key metrics likely to affect your portfolio, making it easy to amend credit policy or refit a model when necessary.

The AINEXT team has years of experience analyzing machine learning credit models and lenders 'businesses. We 're always available for custom reporting and analysis needs.