Transparent, streamlined workflows

Understand, evaluate, and adopt credit models with confidence.

SEE HOWSeamlessly coordinate across stakeholders

"AINEXT satisfies the needs of lenders and regulators. The granularity on the models through their product is so great and provides all the features and details to explain each one of our decisions."

Chief Credit and Risk Officer, Blue Federal Credit Union

Banks that fail to invest in machine learning will end up fundamentally uncompetitive in a couple of years. We found the best way to drive benefit faster was a partnership with AINEXT.

Rodger Hochschild

Discover CEO and President

Goodbye opaque third-party credit scoring

Transparency and control over risk assessment

When you buy credit scoring from someone else, it 's nearly impossible to understand, evaluate, and trust how their model works and making changes can be headache. With AINEXT, you own your model and can make changes easily with full transparency.

Evaluating AI models is easier than you think

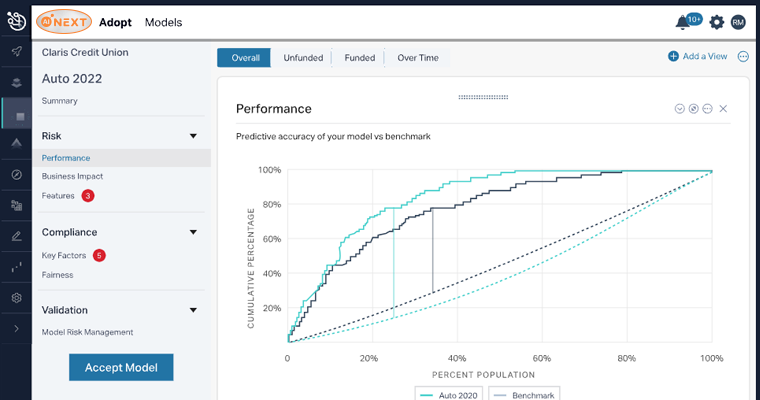

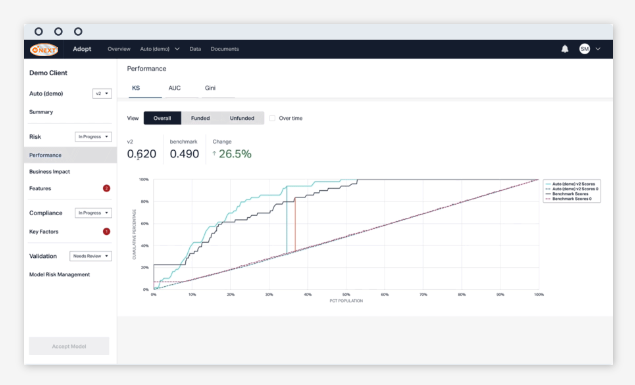

Straightforward automated analysis

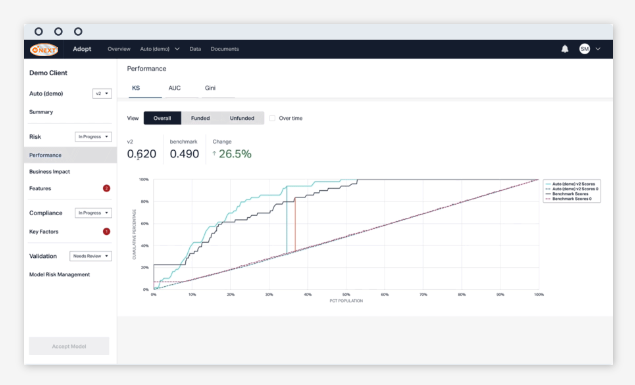

Stakeholders can coordinate quickly to ensure a new model meets business needs and lending objectives; falls within appropriate risk policy and tolerance; and complies with regulatory and fair lending requirements.

Fewer emails, spreadsheets, and tedious documentation tasks

Seamless coordination and workflows

No more digging through inboxes and file versions to ensure everyone is up to speed or wasting hours updating documentation. Every modification is automatically reflected in comprehensive MRM documentation and change logs.

Goodbye opaque third-party credit scoring

Transparency and control over risk assessment

When you buy credit scoring from someone else, it 's nearly impossible to understand, evaluate, and trust how their model works and making changes can be headache. With AINEXT, you own your model and can make changes easily with full transparency.

Evaluating AI models is easier than you think

Straightforward automated analysis

Stakeholders can coordinate quickly to ensure a new model meets business needs and lending objectives; falls within appropriate risk policy and tolerance; and complies with regulatory and fair lending requirements.

Fewer emails, spreadsheets, and tedious documentation tasks

Seamless coordination and workflows

No more digging through inboxes and file versions to ensure everyone is up to speed or wasting hours updating documentation. Every modification is automatically reflected in comprehensive MRM documentation and change logs.

Not sure how to evaluate a machine learning model? No problem.

AINEXT 's team is here for you every step of the way, ensuring you and your team understand what went into your model, how it works, and what to expect.

In fact, we 'll walk you through a preliminary model based on your unique business so you can see for yourself how it all works.

Got Questions?

You 'll receive upfront an accurate assessment of business impact as a result of applying the superior statistical accuracy of a machine learning model to your current portfolio economics.

AINEXT has helped more lenders put AI-driven credit models into production than anyone on the planet. We 've learned—sometimes the hard way—what it takes to get lenders up and running. AINEXT 's software produces comprehensive model risk documentation to satisfy the most stringent regulators.

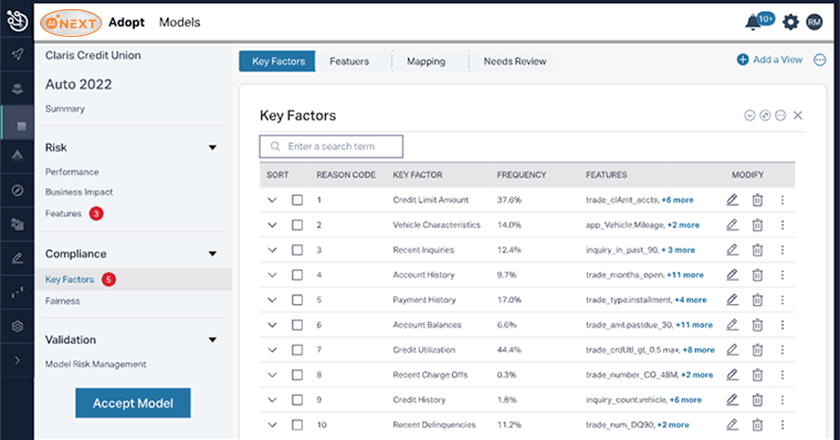

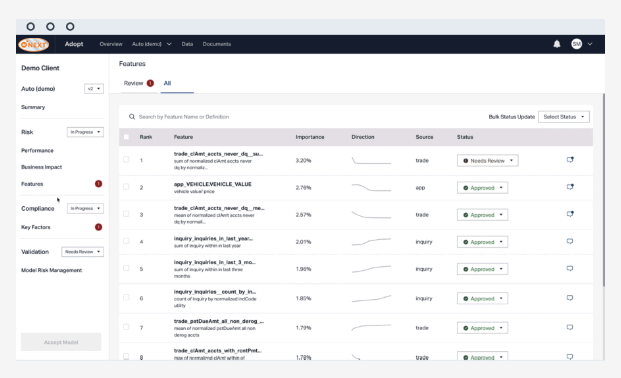

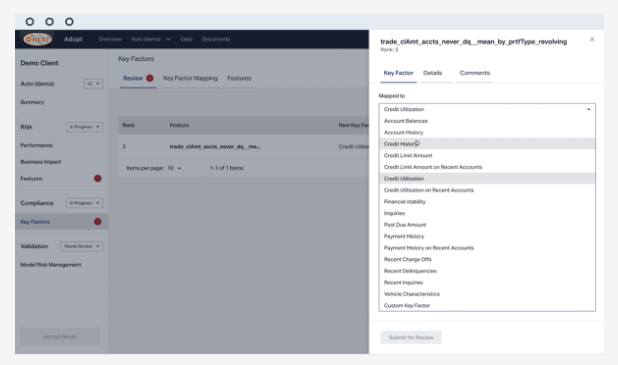

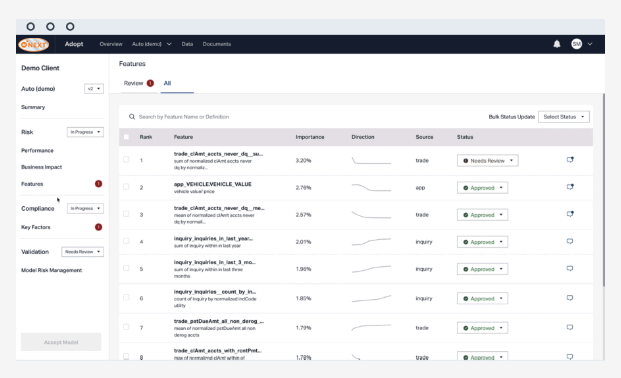

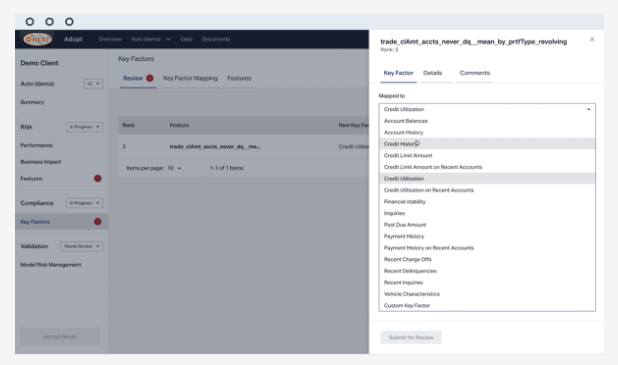

AINEXT 's feature review tables show all the variables used in a model and ranks their importance to the model 's prediction and any disparate impact or treatment. Risk analysts can easily search for features and flag them for review and modification.