AINEXT Model Management System

Everything you need for effective credit model management and easy AI adoption.

learn more

“Banks that fail to invest in machine learning will end up fundamentally uncompetitive in a couple of years. We found the best way to drive benefit faster was a partnership with AINEXT.”

Roger Hochschild

Discover CEO and President

A Suite of Apps to Manage Your Lending

Build

Models that offer best-in-class borrower assessment

Build

The build application does this and is awesome for these reasons and it makes life easier than ever before.

Adopt

Automated and seamless model analysis and validation

Adopt

Documentation, Validation &Compliance more words

Operate

End-to-end performance monitoring in production

Operate

Scoring, Monitoring, &Short words and then Analytics

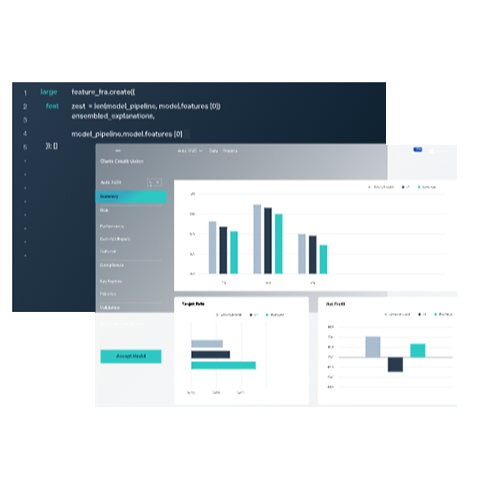

The only complete solution for AI-driven lending

Powerful, compliant, swift, and easy

Take back control over credit scoring with transparency and ease. The MMS comprises three core applications supporting lenders across the entire credit model lifecycle.

Experts in machine learning underwriting

Supporting lenders of all sizes

We 've put more AI lending models into production than anyone out there. With AINEXT, you get a professional team that works as an extension of yours.

Faster, more accurate credit decisions

More data, better math, and smarter software

Tap the hidden value of the data you already own and create risk predictions you can trust across the entire credit spectrum for stronger, more competitive lending.

Software to streamline every stakeholder’s work

The AINEXT Model Management System benefits multiple teams involved in successful lending—including credit risk, compliance, loan operations/underwriting, and even IT.

More than just a new model or fancy scores, the AINEXT Model Management System is the foundation for powerful AI-driven lending.

Lending Leaders

Compliance

Credit Risk