Ensure inclusive, fair lending

Traditional credit scoring leaves too many people behind and impedes loan growth

see our resources

AINEXT is here to help

More inclusive lending is good for people and good for business

See how many creditworthy borrowers you may be leaving behind

Lending with greater intention to drive growth

Improved risk assessment across the credit spectrum led to fairer outcomes and greater growth

Case Study

32%

Increase in approvals for protected classes

The results with AINEXT are impressive, increasing approvals 26% for low-income designated loans, meaning we could deliver more to GreenState members who deserve better.

Amy Henderson

Chief Consumer Services Officer

Chief Consumer Services Officer

$132M

Annual increase in originations

$11M

Additional profit per year

Case Study

The results with AINEXT are impressive, increasing approvals 26% for low-income designated loans, meaning we could deliver more to GreenState members who deserve better.

Amy Henderson

Chief Consumer Services Officer

Chief Consumer Services Officer

32%

Increase in approvals for protected classes

$132M

Annual increase in originations

$11M

additional profit per year

Lenders and bias in credit scoring

Three key takeways from a survey of lenders on the subject of bias in lending.

The era of the fairer credit score

Public sentiment has shifted and raised expectations of financial institutions 'role in equality.

New ways to reduce bias

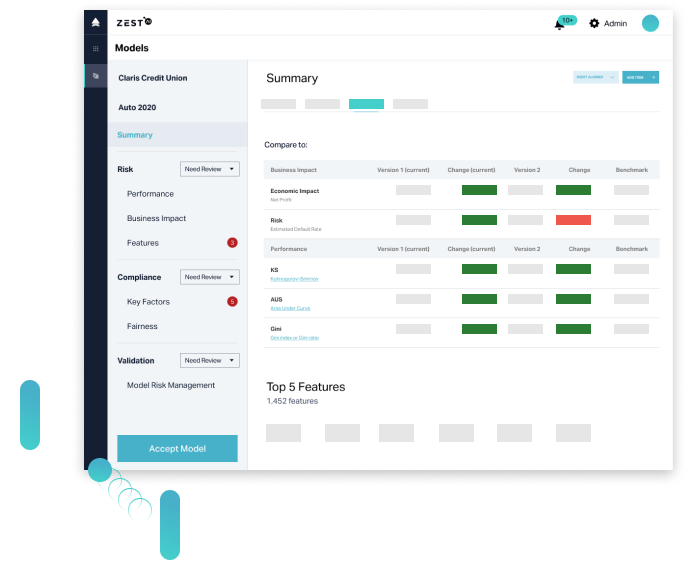

AINEXT 's fairness innovation helps eliminate discrimination in lending.

See how to drive intentional loan growth with inclusivity

AI-driven lending leads to fairer outcomes and better lending results.

Schedule an info meeting