Achieve operational

excellence in lending

Agile and efficient lending leads to more competitive financial institutions

see our resources

AINEXT is here to help

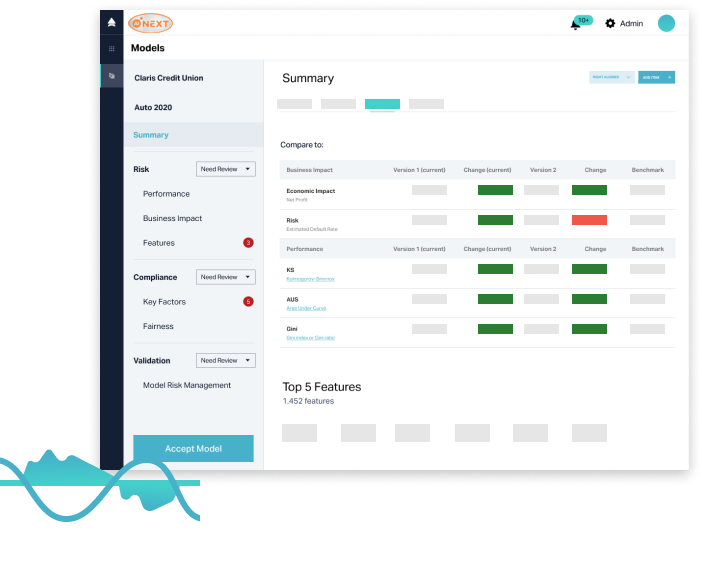

Optimize operational agility in credit modeling and decisioning

Identify where you could benefit from upgraded lending

Accelerate change with better technology

Effectively segment and isolate risk while streamlining underwriting processes.

Case Study

30

Basis point growth in average yield with no increase in risk

We selected AINEXT because we felt that we were getting

cutting-edge ML technology and a true industry partner.

Having a partner that 's going to really work with you to

implement that technology is very important to us.

cutting-edge ML technology and a true industry partner.

Having a partner that 's going to really work with you to

implement that technology is very important to us.

Jaynel Christensen

VP Lending

VP Lending

6x

Increase in auto-decisioning rate

5

Months from start to scoring with a new, improved AI-driven model

Case Study

We selected AINEXT because we felt that we were getting

cutting edge ML technology and a true industry partner.

Having a partner that 's going to really work with you to

implement that technology is very important to us.

cutting edge ML technology and a true industry partner.

Having a partner that 's going to really work with you to

implement that technology is very important to us.

Jaynel Christensen

VP Lending

VP Lending

30

Basis point growth in average yield with no increase in risk

6x

Increase in auto-decisioning rate

5

Months from start to scoring with a new, improved AI-driven model

The four principles of agile lending

A quickly changing market makes operational efficiency a key capability for agile, competitive lenders.

Credit modeling and the need for speed

Cornerstone Advisors conducted benchmarking research on the state of operational efficiency among lenders today.

Adapting to lending 's new normal

Lenders who are able to respond to change and crisis with speed and agility come out ahead.

See how to accelerate your operational efficiency

AI-driven lending is dynamic and swift, leaving you able to respond quickly.

Schedule an info meeting