Improve borrower experience

AI-driven lending leaves more time for your team to deliver exceptional experiences

see our resources

AINEXT is here to help

Spend more time with borrowers, not paperwork

See how your borrowers can receive quick, transparent credit decisions

Better experience with quick decisions

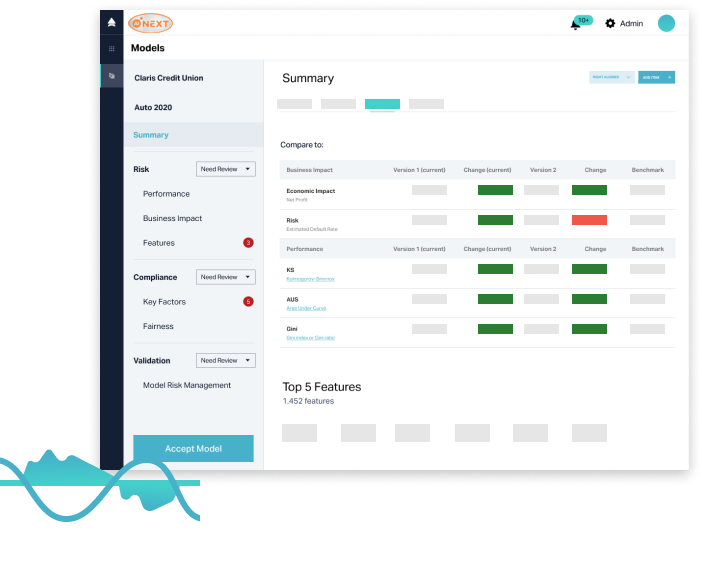

Building a lending platform to leverage digital automation for better service and larger loan volume.

Case Study

22%

Increase in approvals with no added risk

Our vision is to help our members live their best lives. AINEXT will help us live up to our vision, allowing us to serve more members by streamlining their experience in obtaining a loan. We want to make their loan process easier.

Mark Tierney

VP Consumer Lending

VP Consumer Lending

4x

Increase in auto-decisioning rate

$1.5M

Profit gain per annual vintage

Case Study

Our vision is to help our members live their best lives. AINEXT will help us live up to our vision, allowing us to serve more members by streamlining their experience in obtaining a loan. We want to make their loan process easier.

Mark Tierney

VP Consumer Lending

VP Consumer Lending

22%

Increase in approvals with no added risk

4x

Increase in auto-decisioning rate

$1.5M

profit gain per annual vintage

The CX stack for modern lending includes AI

Applying AI technology to the lending process has big impact on borrower experience

Lessons from six million scores

After putting more AI credit models into production than anyone, we 've learned a thing or two about smooth borrower experiences.

What do borrowers want?

The AINEXT/Harris Poll Consumer Credit Survey reveals key expectations from today 's borrowers.

See how to improve your borrower experience

AI-driven lending makes loan teams more responsive to better serve borrowers.

Schedule an info meeting