Exercise greater control over

risk and losses

Smarter risk predictions lead to more good loans and fewer bad ones

see our resources

AINEXT is here to help

Build stronger portfolios with more creditworthy borrowers at higher yields

See where you may be overlooking risk

Managing risk while driving loan growth

Rising charge-offs curtailed lending

for a major national card issuer, but AI reduced loss and drove growth.

Case Study

.svg)

51%

Reduction in charge-off rate

Banks that fail to invest in machine learning will end up fundamentally uncompetitive in a couple of years. We found the best way to drive benefit faster was a partnership

with AINEXT.

Roger Hochschild

President &CEO

President &CEO

10s

of millions of dollars in annual savings

450

model variables used, 17x more than previously

Case Study

.svg)

Banks that fail to invest in machine learning will end up fundamentally uncompetitive in a couple of years. We found the best way to drive benefit faster was a partnership

with AINEXT.

Roger Hochschild

President &CEO

President &CEO

51%

Reduction in charge off rate

10s

of millions of dollars in annual savings

450

model variables used, 17x more than previously

Smart lenders guide to a downturn

Tools, tips, and techniques to effectively manage lending portfolios when risk is on the rise.

Swapping out risky borrowers for better ones

Learn how one lender was able to build a stronger portfolio by better assessing risk and changing the risk profile on their portfolio.

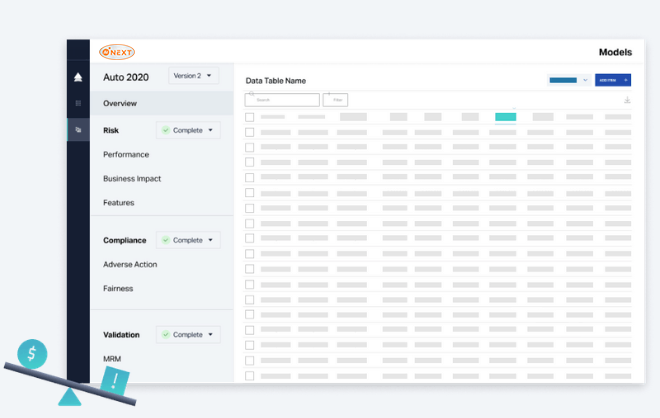

How to de-risk your portfolio with AINEXT

This overview demonstrates how swap-set analyses help lenders understand how to shift the makeup of their portfolio for stronger results.

See how to mitigate risk and reduce losses with AI-driven lending

More accurate prediction and better decisions help reduce risk and control loss

Schedule an info meeting